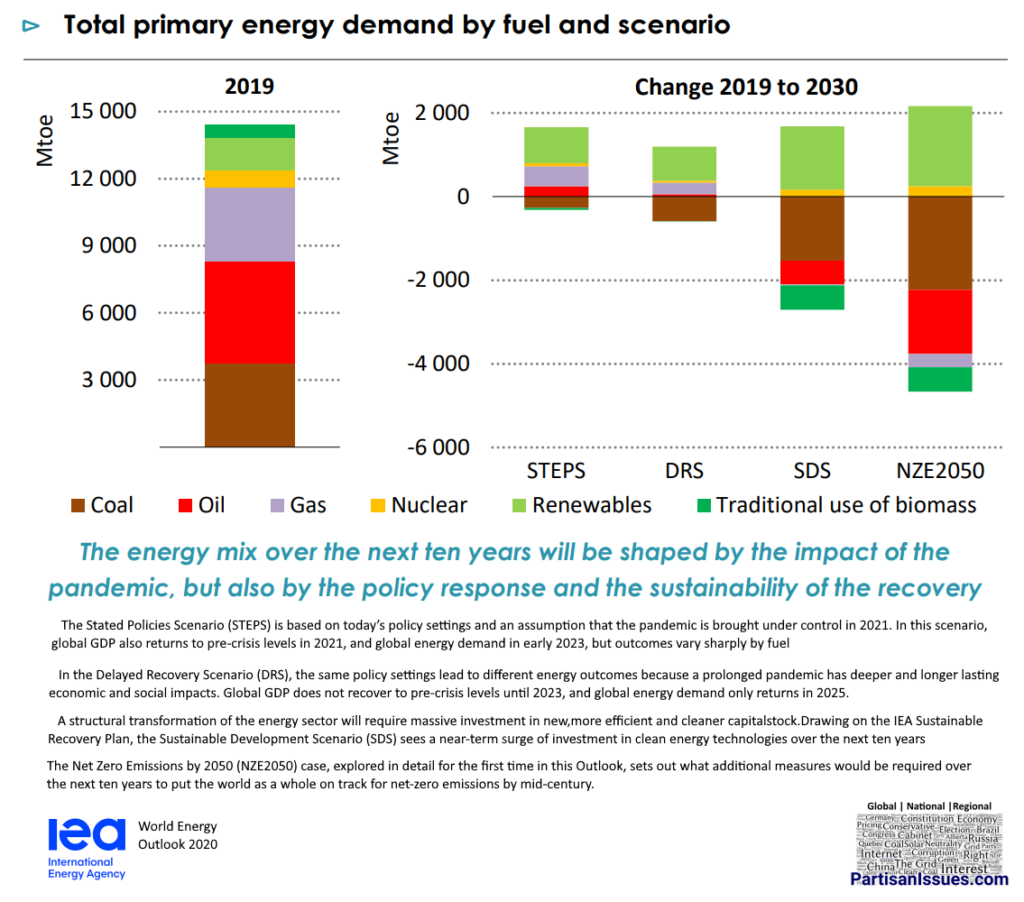

“A huge shock to the system: Our assessment is that global energy demand is set to drop by 5% in 2020, energy-related CO2 emissions by 7%, and energy investment by 18%. The impacts vary by fuel. The estimated falls of 8% in oil demand and 7% in coal use stand in sharp contrast to a slight rise in the contribution of renewables… “IEA World Energy Report

So began the latest large scale report on the energy industry. When combing through the energy industries most reliable, non-partisan research group, the International Energy Agency (IEA) World Energy Outlook for 2020, we were taken aback to see their analysis showing oil consumption, globally, will begin to decline near the year 2030. That shaves the better part of 15 years off their previous predictions when 2045.

“…The era of growth in global oil demand comes to an end within ten years, but the shape of the economic recovery is a key uncertainty. In (two of their four models), oil demand flattens out in the 2030s. However, a prolonged economic downturn (caused by COVID-19) knocks more than 4 million barrels per day (mb/d) off oil demand… keeping it below 100 mb/d.” SOURCE: IEA World Energy Report Page 19

In 2019 the world consumed approximately 100 million barrels per day (mb/d) so the IEA is saying that if the COVID-19 pandemic drags out it is likely (not just conceivable) that we have hit so called “peak oil demand” already.

What Does Peak Oil Mean For You?

For most people peak oil demand will mean very little over the next decade. Contrary to what many social ’causers’ insinuate, it does not mean the end of oil; it simply means that from about 2030 on oil production will BEGIN to DECLINE.

One of the biggest changes will highly visible for cities with oil company head offices and exploration management. Places like Oslo, Calgary, Houston and Denver will experience serious declines in oil sector “office jobs” because oil companies will cut those jobs first. The cities that do not attract new industries, do so at their own peril.

For those workers in the oil exploration and services sectors it is a catastrophic change. Oil and gas companies will start stretching out their existing infrastructure investments (wells, pipelines, storage…) and substantially reduce both capital expenditures on new assets and operating expenditures on maintenance.

Because large scale oil production, mostly via existing assets and reservoirs, will continue for many decades field operations staff have little to worry about in the short turn. That being stated, it oil field maintenance, drilling and low pressure pipeline (the smaller pipes that connect pump jacks to storage tanks or larger pipelines) construction jobs are unlikely to be growth industries. It is also very possible scenario that other energy sources like Hydrogen take up the increasing slack in those field jobs.

In the medium and long run, it will also mean upheaval for those economies that rely on oil revenue. Countries like Canada, Russia, Saudi Arabia, Nigeria and Venezuela have a choice to make, replace oil revenue with something else or face serious reductions in their citizens standard of living.

What Does Peak Oil Mean For Pipelines?

Pipelines have been wrongly politicized in the last decade. Most consumers and politicians think of pipelines as a “sunk cost” asset for the oil industry, much like high tension power lines are for the electric industry. This is wrong headed.

Pipelines can, are and will be used to transport different products in different directions over time. They are reversible and can carry a multitude of products from water to hydrogen; there is even a company in Belgium that repurposed oil pipeline from their brewery on the edge of the city to local bars in the core. Beyond transport, some cities have repurposed old pipelines for storage; why build water storage tanks when you already have hundreds of miles of pipe!

It is important to remember that peak oil demand does not mean that we all stop using oil. The existing pipelines will pump oil, bitumen, gasoline, natural gas… for decades to come because we need those resources.

What is The New Energy Mix?

It is critical to remember that access to cheap reliable energy is the number one predictor of heath. In simple terms that means those with energy are healthier than those without. We need energy; we need much more energy.

Coal and oil account for the vast majority of energy consumed and for good reason. They are both cheap, reliable (i.e. plentiful) and have a massive supporting infrastructures built up over the last 150 years.

While those who have more than just a blind zealous hatred of energy production, correctly say “the stone age did not end because we ran out of stones”, the same logic holds for coal and oil. They will both go be seriously diminished even though they will be readily available in the decades to come.

Grant Strem from Proton Technologies, a facinating hydrogen startup, is fond of a twist on stone age comment by saying:

“…It’s like the going from whale oil to crude oil. It wasn’t that everyone loved whales; its because people found crude oil less expensive” SOURCE

Death of Coal

According to the IEA coal is dieing a quick death due to its highly visible carbon foot print and easy substitution with cheap, reliable natural gas.

“…Covid-19 has catalysed a structural fall in global coal demand… Coal demand does not return to pre-crisis levels in the STEPS and its share in the 2040 energy mix falls below 20% for the first time since the Industrial Revolution. Coal use for power generation is heavily affected by downward revisions in electricity demand and its use in industry is tempered by lower economic activity. Coal phase-out policies, the rise of renewables and competition from natural gas lead to the retirement of 275 gigawatts (GW) of coal-fired capacity worldwide by 2025 (13% of the 2019 total), including 100 GW in the United States and 75 GW in the European Union. Projected increases in coal demand in developing economies in Asia are markedly lower than in previous WEOs, and not enough to offset falls elsewhere. The share of coal in the global power generation mix falls from

37% in 2019 to 28% in 2030 in the STEPS, and to 15% by then in the SDS. SOURCE: IEA World Energy Report Page 20

Death of Oil

The we see oil is nearing its peak:

“…The era of growth in global oil demand comes to an end within ten years…” IEA World Energy Report Page 19

All of this upheaval will not leave the world starving for energy:

Click to Expand Graphic

As you can see in three likely scenarios, coal just keeps declining while oil consumption has has little change through 2030.

It is important to remember that these a global numbers, so places like Norway, Canada and United States will have much more meaningful decreasing in coal and oil use, while China and India continue to expand their use.

0 Comments