In the late 1990’s the term PEAK OIL was coined as a short form for the time when we reach the maximum amount of oil we can produce in a year. It was often misconstrued as the end of oil but was simply when production levels start to decline.

The price of oil steadily increased from near $20/barrel in the year 2000 to near $60/barrel in 2005. However the production volumes did not change. When prices have serious increases but production does not, that is a sure sign of a peak. In this case Peak Oil seemed assured.

Then the global financial crisis hit starting in late 2007 which dropped world wide demand oil commodities and peak oil faded from our lexicon.

By 2013 Peak Oil had been relegated to an environmentalists dream and was not serious discussed in industry or government anymore.

He was wrong about killing the smaller fracing operations primarily in the US. As many of them pulled back production or went bankrupt, there hardware and systems became available to other small players so when the price of oil went up a dollar or two, the US fracing industry would kick back in and produce more oil.

However, he was right that overproduction would collapse the price of oil from a peak of over USD$140/barrel to under $35/barrel. The phrase Peak Oil was now firmly relegated to the history books.

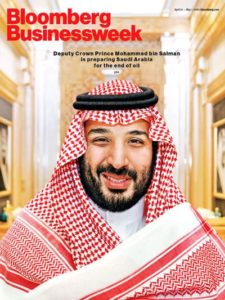

From 2014 to 2018, the Peak Oil was a laughable concept as the production of oil and gas now seemed nearly infinite. Every Wednesday the US Government puts out a report showing the previous periods production numbers. It was not unusual to see oil storage at near 100% capacity as the global players like Russia, Nigeria, Venezula, Saudi Arabia and Canada produced as much as they could to keep cash flows flowing. The US had so much oil and gas, export restrictions were removed for the first time since the 1970’s.

In recent weeks however the Peak Oil concept has been referred to, sometimes by name and sometimes not. How could Peak Oil make a return in this environment?

It would be ease to say that the real cause of this odd situation of rising prices without a matching rise in found reserves is simply caused by the time lag between oil exploration and oil production. Oil exploration on land and marine takes more than a year to get back into gear. Typically oil companies have to:

Now that the fracing miracle has had more than a decade to ferment we have some real numbers to consider and one thing that has always bothered this author is why the Permian (Texas, OK area) have received so much funding support from the stock market while Canadian operators have not. This is truly a highly complex issue that has the roots of its answer in everything from government / regulatory instability and royalties, to a pipeline infrastructures. However, we now know that many fracing operations in the Permian are money losers funded primarily by an ill-informed investor class:

“…the economics just didn’t support bringing the shale oil out of the ground. But investors didn’t listen and kept handing new investment capital in the form of both equity and debt financing to the drillers… those companies currently drilling in the Permian Basin in Texas are involved in yet another bizarre free-cash-flow-negative boom. The Permian has become a Wall Street darling even though it’s actually the latest place where capital goes to die.” SOURCE

Eventually, investors will want a proper return on their investments and move capital out of the Permian. That may take a couple more years to occur putting us near the year 2020. At the same time every energy industry association and government body has been screaming that the 60% drop in exploration (from 2014 to 2017) means that new oil fields and new oil processes will not be discovered any time soon. Given the amount of time it takes to replace the current oil reservoirs we are draining today with new reservoirs, it seems likely that we will hit oil shortages in a couple of

Does that mean Peak Oil will occur near 2020? That is a good question that only time will answer, but given the massive drive to invest in alternate energy sources (wind, solar, 5th gen nuclear…) that are dropping upwards of 20% per year in cost, it does seam possible that Peak Oil will hit in the early 2020’s.

This website uses cookies.